5 surprising trends in car prices: What every buyer needs to know for Fall 2024

Published September 2024

hodium // Shutterstock

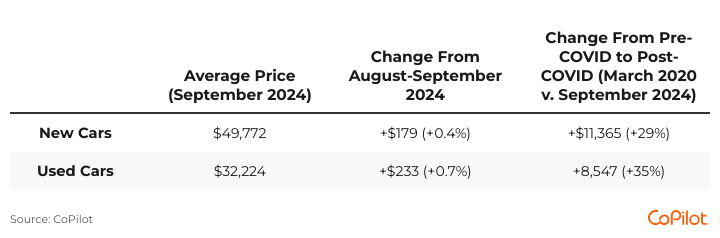

Over the past year, used car prices—which have fallen by 8%—have been one of the biggest factors pulling down overall inflation. Consumers have taken advantage of falling prices this summer, driving up sales and lowering dealer inventory levels. At the same time, with 2021 marking the start of a drop in leased cars, fewer off-lease cars will be returned to replenish dealer inventory this year. As a result, used car prices (now averaging $32,224) will likely soon be on the rise yet again, according to the latest data and analysis from AI car shopping app CoPilot. With insights on various segments and brands, CoPilot explores five key trends that car buyers should be aware of as they navigate the evolving landscape of automotive pricing.

CoPilot

Price Hikes Ahead: How Supply Shortages Are Driving Up Car Prices

The automotive market is entering a pivotal phase as fall 2024 approaches. After a year of declining used car prices, which helped pull down overall inflation, the trend is reversing. Strong summer sales have depleted dealer inventories, with used car stock dropping by 17% between early July and early September. This, coupled with fewer off-lease cars returning to the market, is creating upward pressure on prices.

The window for bargain hunting in the used car market may be closing rapidly. For new cars, while prices have seen a modest 3% decline, averaging $49,772, the upcoming Federal Reserve interest rate cut in mid-September could be a game-changer, potentially making cars in the $25,000-$35,000 range more accessible to consumers.

CoPilot

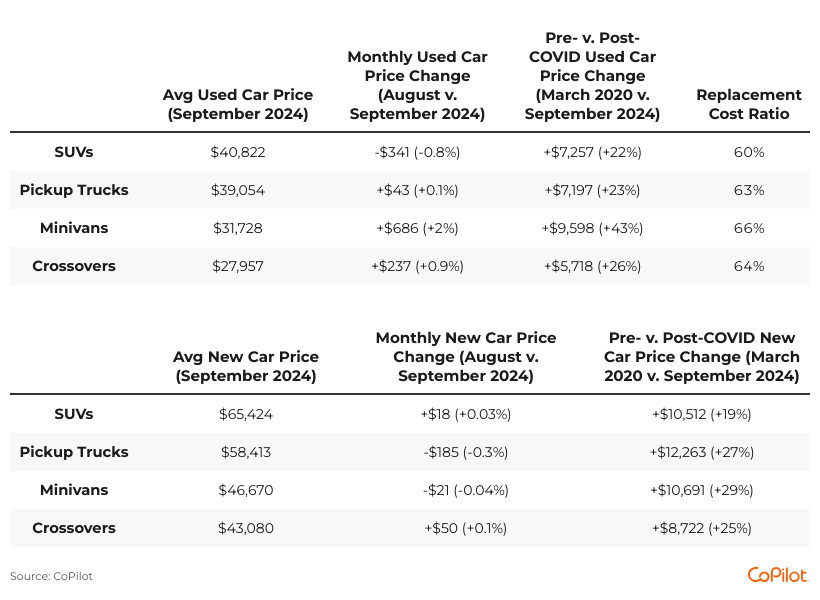

Segment Spotlight: SUVs Shine While Minivans Surge

SUVs continue to be the most stable option, with used models averaging $40,822—up only 22% since pre-COVID levels. This stability makes SUVs particularly appealing, as they are worth approximately 60 cents on the dollar compared to new models. Conversely, minivans have experienced the steepest price increases, with new models up 29% and used models up 43% since March 2020, driven by their renewed popularity among families seeking spacious and versatile vehicles.

Pickup trucks and crossovers also show significant price increases, with new pickups up 27% and crossovers up 25%. These trends indicate sustained demand for these segments, likely due to their versatility and utility. As inventory levels for used cars continue to dwindle—down 17% in recent months—buyers may want to act quickly, particularly in segments like SUVs, where prices are more stable, before anticipated price increases take effect.

CoPilot

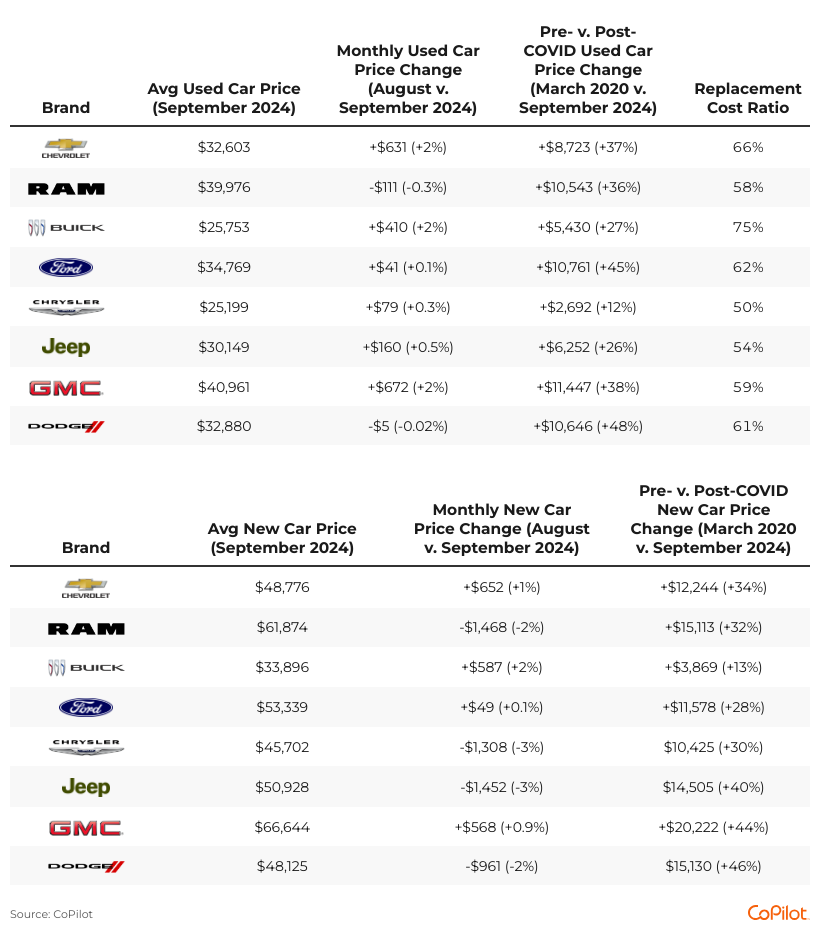

American Value: Why Domestic Brands Are Holding Their Ground

Among domestic brands, Chrysler stands out as a beacon of affordability in the current market. Used Chryslers are only 12% more expensive than their pre-COVID prices, averaging $25,199, and are worth 50 cents on the dollar compared to new models. This pricing strategy, coupled with elevated inventory levels of 108 market days supply, suggests that dealers may be more willing to negotiate on Chrysler models, presenting an opportunity for savvy buyers.

However, not all domestic brands follow this trend. New Dodge prices have surged 46% above pre-COVID levels, closely followed by GMC at 44%. With such varied pricing dynamics, buyers should carefully consider their options across different domestic brands to find the best value in the current market. Using a free VIN lookup tool for detailed information on a given vehicle can help.

CoPilot

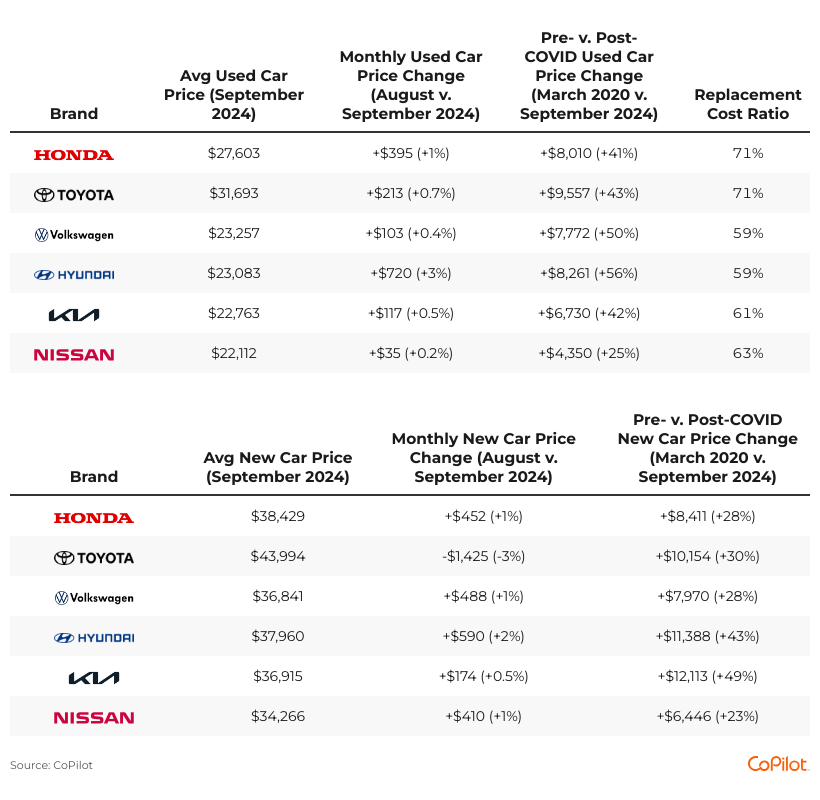

Market Shifts: Foreign Brands Respond to Consumer Demands

Toyota’s 3% price drop in new cars over the past month signals an aggressive move to maintain market share, likely in response to increased competition from domestic brands and the growing EV market. This price reduction strategy could also be a preemptive measure against potential economic headwinds, aiming to keep sales volumes high even if consumer spending tightens.

In contrast, brands like Kia and Hyundai are holding firm or even increasing prices slightly, building on their successful repositioning as value-packed, feature-rich alternatives to more established brands. This pricing strategy reflects confidence in their brand equity and product lineup

CoPilot

Luxury for Less: High-End Brands Adjust to Market Realities

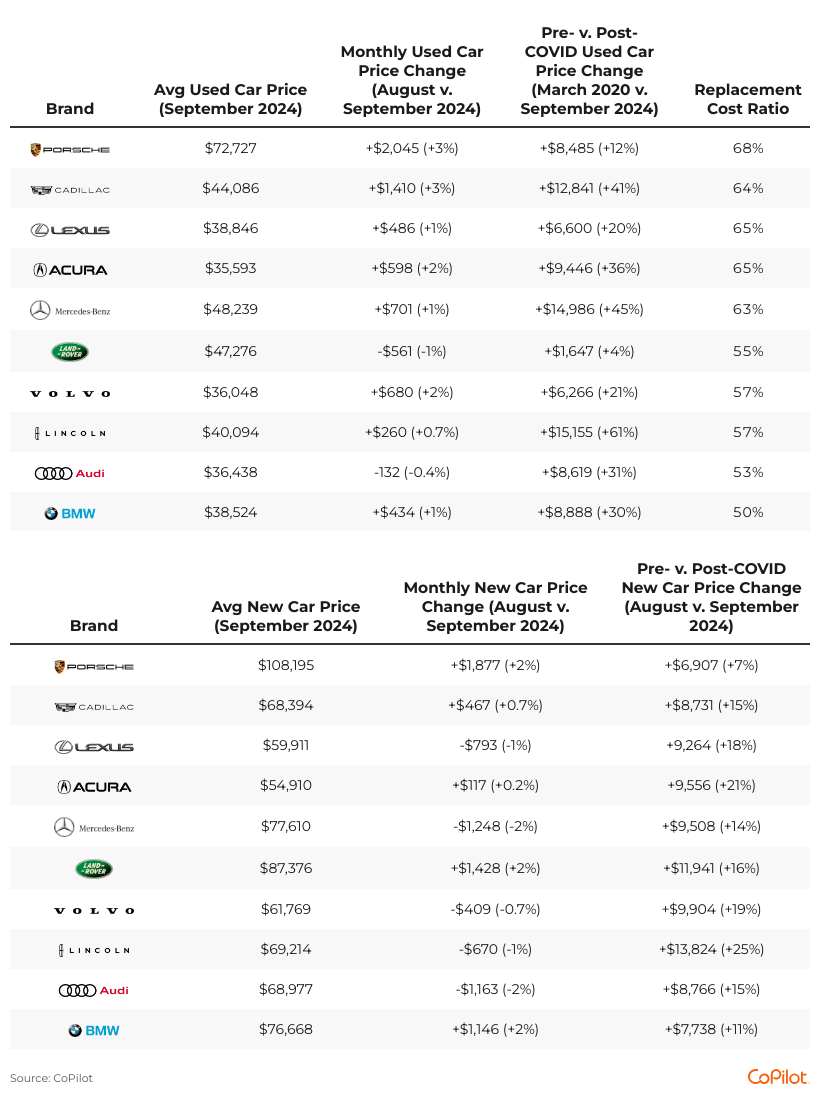

New Mercedes-Benz and Audi models saw the largest price drops in August, both down by 2%, signaling a potential shift in strategy to attract buyers who may have been priced out of the luxury market in recent years. In contrast, Porsche stands out as the luxury brand that has maintained pricing closest to pre-COVID levels, with new models only 7% above March 2020 prices. This pricing discipline suggests Porsche has successfully preserved its brand value through the market turbulence.

In the used luxury market, Land Rovers are nearly back to their pre-pandemic pricing levels, just 4% higher than in March 2020. For those seeking the best bang for their buck in the luxury segment, used BMWs offer the most value, worth just 50 cents on the dollar compared to new models.

This story was produced by CoPilot and reviewed and distributed by Stacker Media.

Cole Miller

Popular Car Searches

Makes

Shop Used Cars

Used Subaru Forester for Sale Near Oklahoma City, OK

Used Buick Wagon for Sale Near Me

Used Ford Explorer for Sale Near Centennial, CO

Used Ford Mustang for Sale Near New Orleans, LA

Used Porsche Convertible for Sale Near Me

Used MINI Hatchback for Sale Near Me

Used Toyota 4Runner for Sale Near Jacksonville, FL

Used Subaru WRX for Sale Near Cleveland, OH

Used Mazda Minivan for Sale Near Me

Used Ford F-150 for Sale Near Oklahoma City, OK

Used Cadillac Convertible for Sale Near Me

Used Audi Hatchback for Sale Near Me

Used Subaru Suv for Sale Near Me

Used Nissan 370Z for Sale Near Atlanta, GA

Used BMW Sedan for Sale Near Me

Used Nissan Sentra for Sale Near Los Angeles, CA

Used Ford Fiesta for Sale Near Me

Used Nissan Maxima for Sale Near Me

Used Subaru Outback for Sale Near Me

Used Mercedes-Benz Van for Sale Near Me

Used Toyota Tacoma for Sale Near Baton Rouge, LA

Used Honda Pilot for Sale Near Birmingham, AL

Used Toyota Tacoma for Sale Near Me