Stellantis at a Crossroads: Sky-High Prices and Inventory Alienate Consumers and Dealers, While Threat of Another UAW Strike Looms

September 2024

Stellantis – the parent company of U.S. car brands Chrysler, Dodge, Jeep, and Ram — is facing some serious challenges. With prices still extremely elevated from pre-COVID norms, its U.S. sales are down significantly, by 21% year-over-year as of Q1. Dealer inventories of key brands are piling up on lots, forcing Stellantis to consider new ways to help clear stock including potential price cuts and incentives.

Excess inventory means pressure is mounting for a quick turnaround in late 2024. Some critics fault Stellantis for perilously overestimating the loyalty of core consumer audiences of brands like Jeep, pushing lofty premium sticker prices despite the brand’s lingering reputation of below-average reliability. For example, 2023 marked both the brand’s fifth consecutive year of annual sales declines and highest annual average transaction price in the U.S.

Unless consumers start seeing deeper price cuts and competitive products from Stellantis, dealers will likely have to continue paying the price and hold onto unwanted inventory. If consumer demand remains weak, Stellantis’ U.S. facilities may experience further slowdowns and layoffs of auto jobs. On top of it all, the United Auto Workers (UAW) union also recently announced plans to hold a strike authorization vote against Stellantis for abandoning contract commitments.

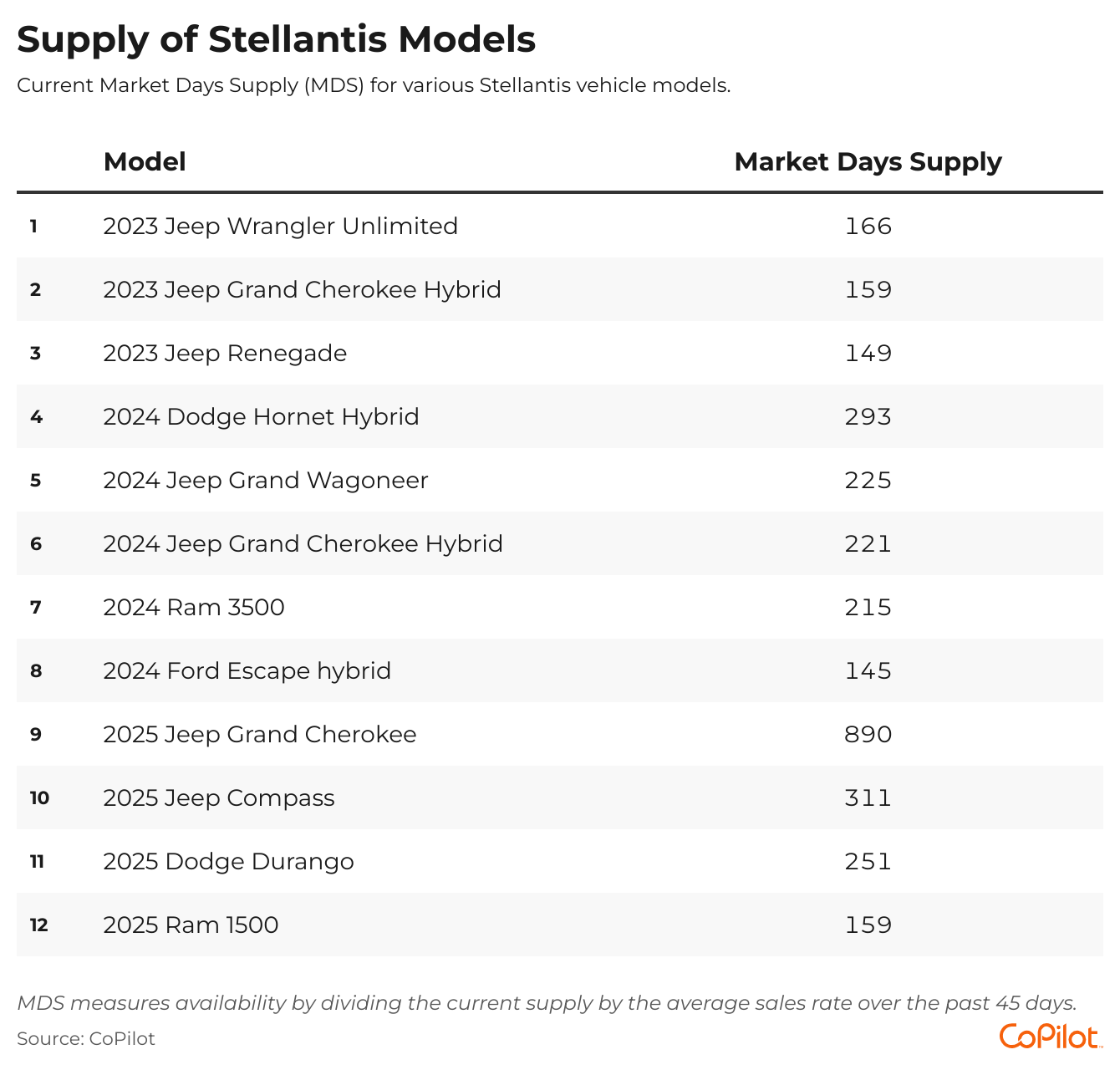

As a result of these challenges, some Stellantis makes and models have eye-popping inventory levels on dealer lots, due to a lack of consumer interest. CoPilot has compiled below some examples of Stellantis vehicles with extremely high market days supply (MDS), which measures how many days it would take to sell all available inventory of a particular model. The average MDS for a new car is 67, so the fact that a number of vehicles have double or triple that amount is a clear signal of the brand’s overall struggles.

Additionally, compared to some of its key competitors, inventory of popular Stellantis brand is significantly higher, illustrating the scope of the issues it’s facing:

Ram 1500: 131 market days supply

- Ford F-150: 89 market days supply

- Chevrolet Silverado: 90 market days supply

- GMC Sierra: 86 market days supply

Jeep Grand Cherokee: 111 market days supply

- Ford Bronco: 108 market days supply

- Kia Telluride: 57 market days supply

Jeep Wagoneer: 137 market days supply

- Chevrolet Tahoe: 80 market days supply

- Ford Expedition: 115 market days supply

- GMC Yukon: 82 market days supply

Jeep Compass: 106 market days supply

- Honda CR-V: 42 market days supply

- Hyundai Tucson: 56 market days supply

Chrysler Pacifica: 97 market days supply

- Toyota Sienna: 18 market days supply

- Honda Odyssey: 43 market days supply

- Kia Carnival: 60 market days supply

Popular Car Searches

Makes

Shop Used Cars

Used GMC Truck for Sale Near Me

Used Ford Mustang for Sale Near New Orleans, LA

Used Chevrolet Convertible for Sale Near Me

Used Honda Accord Sedan for Sale Near Tacoma, WA

Used FIAT Suv for Sale Near Me

Used Nissan Rogue for Sale Near Memphis, TN

Used Ford Fusion for Sale Near West Valley City, UT

Used Toyota Yaris for Sale Near Sanford, FL

Used Ford Edge for Sale Near Hartford, CT

Used Mitsubishi Sedan for Sale Near Me

Used Subaru Coupe for Sale Near Me

Used BMW Coupe for Sale Near Me

Used Honda Odyssey for Sale Near Kansas City, KS

Used Nissan Rogue for Sale Near New Orleans, LA

Used Chrysler Convertible for Sale Near Me

Used Ford Sedan for Sale Near Me

Used Dodge Minivan for Sale Near Me

Used Chevrolet Sedan for Sale Near Me

Used Ford Bronco for Sale Near Me

Used Ford Fiesta for Sale Near Me

Used Kia Sedan for Sale Near Me

Used Mercedes-Benz Wagon for Sale Near Me

Used Nissan Crossover for Sale Near Me